Building a personal financial app — a UX case study

A junior UX/UI job test

After I post about my UX journey, I decided to apply for a job as a UX/UI Design Junior. It was my first application since I started studying this field. They gave me this challenge and as I was allowed to post it, I thought it could be nice to share my process and learnings.

⌛️ I had 7 days to do it.

🇧🇷 It was all in Brazilian Portuguese

Kindly note that I translated the screens and the case study for this article. English is my second language, so please let me know if something sounds too awkward.

️The problem

"Today most Brazilians don't manage well their money. They end up getting out of control and come to the end of the month full of debt.

These expenses accumulate over time until a person loses control completely becomes very difficult to recover."

The challenge

"Thinking about this, you have the challenge of building a platform (desktop or mobile — you choose) of money management, in which the user can insert their expenses daily and have the vision of how much money they still have available for the month. Thus balancing revenues and expenses.

Remember that you have to give incentives for the user to enter the

daily expenses and that generating reports with charts can help the user to

have a better understanding of their financial life."

Some thoughts and feelings

- 🤩 I'm really excited to do it!

- 👀 Why do the Brazilians don't manage well their money? Are there so many Brazilians failing at it? Is this platform a good solution to this problem?

- 🤔 They already gave me a solution, should I invest my time understanding the why's?

My process

I started structuring my process following the design thinking approach, with the exception of the last stage of validation.

Online Research

Through online research, I found some answers to my previous questions. This research showed that 36% of Brazilians don't manage well their money.

Some think it's not important and said it can be done off the top of one's head, others have problems with discipline and some don't prioritize it as they feel lazy or said that don't have time.

Those who manage their money, more than a half find it difficult to do it.

Maybe those who feel difficulty in managing their money, don't do it so well. Both groups showed a lack of discipline.

Major pain points: discipline and financial education.

Even though the previous research showed that only 10% use apps to manage their finances, this survey showed that stills half of the people are connected to the internet exclusively through the cell phone.

Based on this number and the following reasons I decided to create a mobile platform:

- Easy to keep tracking expenses at the time of the transactions;

- “Mobile first” approach.

Job Map

I did a Job Map as a way of empathizing, thinking of the person’s behaviors and needs. I started discovering, based on online research and my assumptions, the core functional job, which was:

•Manage my finances among the month.

After defining it, I deconstructed the steps of this job, almost like a journey map focused on what they are trying to get done (a needs view), instead of what they are doing (a solution view).

Due to time constraints and personal decision for this study, I assumed the desired outcomes in each step, that is how the person would measure the success of doing the job. In a real case, it would be required qualitative research.

Then I defined the importance and estimated satisfaction for each desired outcome. Here it would be required quantitative research.

I used the formulas of ODI and Dan Olsen to see which metrics (desired outcome) I should focus on.

Job Story

Below is the job story of each unmet needs for the problems I focused on.

✳️When I'm trying to manage my budget among the month, I want solutions to:

- decrease time writing the transactions

- decrease the chance that I will not be motivated to write down the expenses

- decrease the chance of forgetting a bill

- decrease the chance that I do not know how to do the math

- decrease the chance of spending more than I can

- decrease time following the daily transactions

- decrease the chance I'll not understand my expenses

- decrease time analyzing the transactions of the month

- decrease the chance I'll not know how much money I have

- decrease time determining how much money I have

💚 and to feel calm when dealing with my finances.

Legend of the sentences above:

✳️ = Core Functional Job

💚 = Emotional job

Benchmarking

I researched apps related to finances, budget and habit-building and I end up with 16 apps. Then I filtered the ones related to financial management and with an interface in Portuguese, as they could be the main competitors.

There were 7 apps at this point and I was looking for their current features, and the overall experience using some of them. Here are some features I found related to the opportunities of the research:

- 2 of the 7 apps sync bank accounts automatically;

- 1 of the 7 reads SMS from the bank and add as a transaction — the person has to copy the message and add in the app;

- 4 of the 7 send notifications;

- 7 of the 7 apps use charts to illustrate some expenses and transactions.

Sketching

I did a few quick sketches to help me organize my thoughts and to outline the app.

Suggested Solution

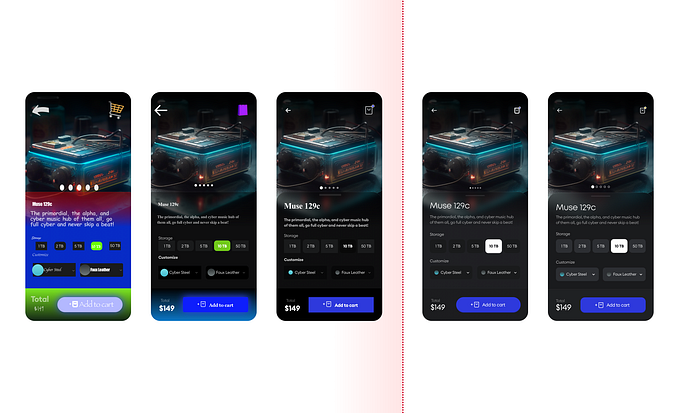

High-Fidelity Prototype

I tried to focus on features related to solving some of the major desired outcomes found in the job map and online research.

The app should be simple and easy to understand. Also, encouraging to build financial habits. Here are the highlighted features:

1. Easy and fast to add transactions and motivating to do it

Legend:

🎯 = Pain points addressed

🎯Decrease time writing down the transactions

🎯Decrease the chance of not being motivated to write down the expenses

The app would sync bank accounts and categorizes the transactions automatically. For the expenses made with cash — the ones it doesn't sync automatically — there would be an easy and fast way to do it.

When in the app, the person clicks on the plus button and choose to add a transaction by text message or voice.

Only a few steps: holds the button > say a sentence indicating how much money was spent or earned > confirm the information the app has read.

On the image below, the left screen shows how to use the text message to add a transaction. Is a free text with no further steps, like writing in a WhatsApp conversation.

The right screen below shows the reminder with a quick reply inviting to insert the transactions that happened during the day.

Motivating a healthy financial habit

🎯Decrease the chance of spending more than they can

🎯Decrease the time following the daily transactions

🎯Decrease the chance of not know how much they have

At the first time the person uses the app there's a quick onboard explaining about the importance of building healthy financial habits.

If allowed, the app will send a daily reminder to check the budget and insert transactions made with cash.

Financial education and money awareness

🎯Decrease the chance of not understand the expenses

🎯Financial Education

As people are closer to credit cards and online payments they get less contact with the cash and consequently less perception of the value of the money or even if there's any to spend.

In this study, for example, they found that shoppers spend up to 100% more when using the credit card to pay, rather than in cash. There are some explanations for that, one is that paying with the credit card people tend to decoupled from emotion and to focus on the benefits of the purchase instead of the cost.

To bring awareness of the value of money back, and avoid spending more than they can, the app will show analogies of some transactions relating it to how many hours of work this transaction represents. Kind of like this:

The system would have to know how much money they earn and how many hours. So it can track transactions made on a non-essential category (e.g. clothing, gifts, etc.) and show the analogy of what that expense represents in hours of work.

The budget is displayed on a card in the main screen and after looking at it, the person can click to check that she/he read.

The app displays how many consecutive days this person checked the budget.

In the example below the person is following for 2 days straight and the milestone is within 100 days — an approximate number needed to build a habit.

Illustrative charts

🎯Decrease time analyzing the transactions of the month

🎯Decrease the chance of not knowing to do the math

There are illustrative charts and comparisons of the expenses of one month to another.

Tips

The app calculates the average spending in a category and create a budget based on spending patterns, then generate tips about how much is needed to stay on the budget.

Limitations of this solution

- Due to time constraints I based the Job Map in my own assumptions and online research, I didn't interview anyone to gather data;

- The opportunities scores from Job Map were also based on my assumptions. An ODI survey would require quantitative data of about 100 answer to have a statistic representation;

- I didn't test my prototype. It would be important to give scenarios in a usability test and validate my assumptions.

Take-Aways

It was a good challenge to learn how to prioritize process and features, how to prototype using Figma, and have an idea of how can be a job interview of a UX/UI design junior.

Even though they gave a platform as a solution, I think the time invested in the online research and job map (based on my assumptions) was still important to provide some insights for features I didn't see on the benchmark.

As the deadline was tied I tried to focus on what I thought it was important, like understanding the problem to them generate ideas and design it. Still, I think it would be important to validate my proposal with some people.

Overall, I'm glad I did it.

😊Thanks to Renato that was patient and supportive in all this process.

Thanks to Isa that gave me feedback after I sent the case to the company.

Thank you for reading and for your claps👏 if you enjoyed this article.

This will encourage me to continue sharing my journey.

If you have any feedback, I’d like to hear from you.

Find me on Linkedin.

Here is an update about my UX designer journey: