What the hell is going on with the UX in cryptocurrency?

Everything is confusing. Are the Crypto experts making everything confusing on purpose?

I am a father and I don't want my kids to be in the future like "yeah… so my dad missed this opportunity, he never invested in Bitcoin. I can't believe he missed this". And all their friends, in the future, flying away in drones laughing and mine still driving a Fiat 500…

What did I do? Studied about Bitcoin, Ethereum, Litecoin, Ripple and all the Blockchain stuff. I studied hard. I also did further reading about Crypterium, Trezor and Ledger (bitcoin Wallets) and the open-source ones like MyEtherWallet. And last but not least, read a bit about mining. I was like:

What have I learned? Nothing.

Really.

What I know about real money? I work > I get paid > The money goes to the bank (which exists, and I can even see banks on the streets).

If I want to use the money I can use a plastic card (accepted everywhere) or paper money (which I can also see and touch). That's it. Everything else about real money is a variation of that. It's easy, seamless and straightforward.

At this moment the crypto experts are reading this "pffff… look at this guy. He can't even understand the open-source next generation data preservation market network and decentralized peer-to-peer blockchain.".

So, from the start, the creator of Bitcoin and blockchain is Satoshi Nakamoto… who is a unknown person or "people".

Okay… This is not that bad, since Häagen-Dazs is also not the name of a Norwegian or Swedish family. It's just a name created by two americans who thought it would help them sell more ice-cream (and it did, it's absolutely delicious. Thank you).

The difference is that if 💩 hits the fan I know where to find the two americans and know who they are. With bitcoin the hole is a lot deeper. Here are some curious articles about him:

- How the NSA caught Satoshi Nakamoto

- Who is Satoshi Nakamoto? Bitcoin creator whose identity is unknown but could be one of the richest people in the world

- We need to know who Satoshi Nakamoto is

If you think this is not important, that's fine… let's move on to understand how to buy a bitcoin. If you don't know how to buy a bitcoin, don't worry, because I don't know either, you are not alone 👊

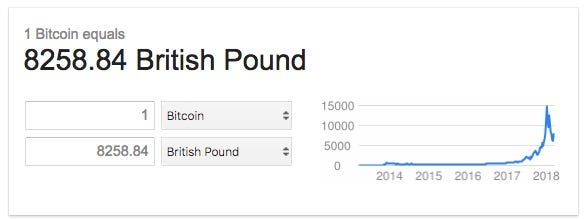

If you google "How much is 1 bitcoin worth", you will get this (results shown on the 3rd of March, 2018).

What I know (and actually, what is cool about Bitcoins), is that there is a finite number, 21 million Bitcoins in total. Where they are, no one actually knows… you would need to mine them. This is from Investopedia:

Bitcoin is like gold in many ways. Like gold, Bitcoin cannot simply be created arbitrarily. Gold must be mined out of the ground, and Bitcoin must be mined via digital means. Linked with this process is the stipulation set forth by the founders of Bitcoin that, like gold, it have a limited and finite supply. In fact, there are only 21 million Bitcoins that can be mined in total. Once miners have unlocked this many Bitcoins, the planet’s supply will essentially be tapped out, unless Bitcoin’s protocol is changed to allow for a larger supply.

This was going well, until "Unless Bitcoin's protocol is changed to allow for a larger supply".

So is it finite or not?

At this moment the user (myself included) is as lost as a blind person in a shootout.

But the user is brave, relentless and decides to try to buy some cryptowhatever. He asks for "easy" suggestions and hear things such as "Coinbase", or "Etoro". Alright… let's analyse Coinbase:

I decided to try and invest something, not as much as 8000 pounds for the simple reason of: I don't have it.

So I've decided to try with 90 pounds. Coinbase shows the following screen:

Clicked on "Add a Payment Method" and I can see two options:

In case you are making a SEPA (international transfer), Coinbase will only tell what banks are supported when you type the bank name into the field 🙄

After a bit of struggle and 30 days to confirm my payment (at that time, they told my my bank was not supported, but only AFTER I made the SEPA transfer), my 90 pounds were visible in my account. And finally I would buy my bitcoins to make sure my kids could fly with their friends in the future.

This is the e-mail I received:

If I go to my account, I see the following:

Like I said, I am not an expert at cryptocurrency, but I am a User Experience Designer and I love the user. I always tell them the truth. Here is a quote I love, from Mike Maples, Jr:

Integrity is the only path where you will never get lost.

By having a first (second and third) look at that screen: what do I really have? A Coinbase account? What if they fail? Are they mining (whatever this means)? Do I really own 0.0111 Bitcoins? Where is this stored? Who am I buying from? I have 100% of what? What is this EUR Wallet? Why is it so confusing? Are they telling me the truth?

At least I have one answer, what is a Coinbase account:

Each account on Coinbase is a collection of addresses. New addresses are automatically generated for each payment on Coinbase and stay associated with your account forever (so it is safe to reuse them).

Easy peasy, right?

If you think the problem is with Coinbase (which is the "easiest" way to buy cryptocurrencies) let's have a look at a "Free, open-source, client-side interface for generating Ethereum": MyEtherWallet.

Wait, "generating"?

Anyways… This is the top bar at MyEtherWallet:

What do you mean "Don't get phished, please!"; of course I don't want to! But don't worry, because If you are in doubt and/or don't know what phishing might even be, they help you with this step by step:

1. Get yourself a Ledger or TREZOR Hardware wallet.

2. Bookmark your crypto sites.

3. Install EAL or MetaMask or Cryptonite by Metacert to warn you if you go to a malicious website.

4. Run MEW Locally / Offline.

5. Do not trust messages or addresses or URLs sent via private message. Always verify information w/ a secondary source.

6. Turn on 2FA for everything.

7. For Token Sales: do not trust any address except the one posted on the official site.

8. Double check the URL & Triple check Github URLs.

9. Always verify that the site you landed on is legit.

9b. Always verify that the Twitter account is legit (look for the blue checkmark!)

10. Google the service name + “scam” or “reviews”

11. Don’t ever run remote-access software (e.g. TeamViewer)

12. Install an adblocker that actually turns off Google/Bing Ads.

13. Don’t click on advertisements.

14. If you have accidentally visited or typed a malicious site, clean out your recent history and autocomplete.

15. No one is giving you free or discounted ETH.

16. The guys who just finish their token sale don’t want to sell you tokens via Slack DM.

17. Install the MEW Chrome Extension.

18. Don’t use brain wallets

19. ONLY unlock your wallet when you want to send a transaction. Check your balance via https://etherscan.io/, https://ethplorer.io/

20. Lastly: use your brain

This made me feel as lost as a cat on a moving day.

And I am "trying to use my brain", what the ???

If the list above isn't enough they continue with "Don’t click any link regarding anything crypto, money, banking, or a service like Dropbox / Google Drive / Gmail in any email ever."

Quite reassuring, huh?!

Ok… Maybe Trezor is easier. It’s “The original & most secure hardware wallet.”

This is what they tell users about “online wallets”:

There are also many online bitcoin exchanges where you can change normal currency to bitcoins. Most exchanges will also provide you with a service of holding your bitcoins for you in their own web wallet. This is not safe at all and many people have lost their bitcoins by trusting them to such services. If you buy bitcoins online, always make sure that you can send them to your TREZOR immediately after purchase!

If Bitcoins and Cryptocurrencies are the future, how come it is so unsafe?? As a user I am not only lost, but scared.

And Trezor (or Ledger) are ONLY wallets; the place where you store the bitcoins. To buy and sell you need to use, for example, the super friendly MyEtherWallet.

And experts trying to help are not helping at all. This is from "Blocgeeks":

What are cryptocurrencies really?

If you take away all the noise around cryptocurrencies and reduce it to a simple definition, you find it to be just limited entries in a database no one can change without fulfilling specific conditions.

(I am running out of gifs, here…)

What are the specific conditions? Where is this database? Is this the bank?

If you are a bit confused, they made a diagram do explain, here it is:

They continue with:

Confirmation is a critical concept in cryptocurrencies. You could say that cryptocurrencies are all about confirmation.

As long as a transaction is unconfirmed, it is pending and can be forged. When a transaction is confirmed, it is set in stone. It is no longer forgeable, it can‘t be reversed, it is part of an immutable record of historical transactions: of the so-called blockchain.

Why would a transaction be unconfirmed? How does this happen? Can it be forged?? What if a transaction is made with a mistake, is it a good thing to be set in stone? Can I revert a confirmed transaction I made with the wrong amount?

If "confirmation is a critical concept in cryptocurrencies", I can confirm that I still didn't get it.

If Bitcoins and all the cryptocurrencies might be the future, and it's up to us (humans) to use it, then a human-centered approach is mandatory.

I studied, researched, talked with friends and still have absolutely no idea what exactly is cryptocurrency, how to properly buy (or whatever fancy word there is for this type of "cryptotransaction") and/or store this new "money".

As a UX Designer I see an OCEAN of opportunities to simplify all these very complex journeys. Maybe we will even see (I am certain this will happen) titles such as "UX Crypto Designer", or "Crypto Experience Designer".

As a human I see an OCEAN of confusing information and a lot of work that I have to do to go through all this Bit-Ether-Crypto-Currency hype and try to sort out myself.

My conclusion is, I REALLY don't think this should be as confusing as it is. They claim cryptocurrency is decentralised, which is the magical and great part about it. Ok, agreed, but the information cannot be decentralised, otherwise there will still be suspicion, mistrust, doubt, questions, cynicism and disbelief.

Thank you for your time reading. If you know (or don't know) about Cryptocurrency, let's talk on the comments below.