New Product Development

Exploring Process, research methods, tools and frameworks in building a successful product

The objective of this blog is to outline a process for New Product Development that looks to de-risk the traditional approach to hardware product development by extensively testing using qualitative and quantitative methods at every stage. Taking a consumer hardware product as the subject, I will explore the different research methods that can be used, recommendations on when they should be used, the tools to run the research and the frameworks to view the findings. Additionally, I explore how the design thinking approach can be applied to the hardware (devices) world and its traditional product development process.

The objective of this blog is to outline a process for New Product Development that looks to de-risk the traditional approach to hardware product development by extensively testing using qualitative and quantitative methods at every stage. Taking a consumer hardware product as the subject, I will explore the different research methods that can be used, recommendations on when they should be used, the tools to run the research and the frameworks to view the findings. Additionally, I explore how the design thinking approach can be applied to the hardware (devices) world and its traditional product development process.

The New Product Development (NPD) process outline

Strategy Phase

This is the stage within New Product development where the Business Case for the product is made. The Business case will include all the information required to make a business decision such as Market size, Target customer segment, Product definition (feature set), Product portfolio, Value proposition, Pricing, Forecasts, and Financial model.

What then is the optimal way to approach the research work to seek these answers?

Start with Qualitative research. You need a few hypotheses first, and it is through one on one Interviews followed by Field Observation that you will land on your hypotheses. Your objective should be to have a good sense of all of the following at the end of the sessions

1. The Personas

2. The use cases

3. The equipment in use and the buyer decision process

4. The motivations

5. The frustrations

6. The detailed workflow

Qualitative research is especially useful when the category is still in its infancy. Let me give you an example of where we employed this to good effect. Some years ago, I was the Product Marketing Manager tasked with building the case for a Prosumer VR camera. We had a flagship product that was focused on the creative studios (Universal, Sony etc.), and our goal was to democratize that technology. As you’d expect the target segment we had in mind was the Independent professional. There wasn’t much doubt in this. These individuals typically focused on one of the following segments→

- Real estate, Architecture, Hotel groups, Restaurants and Retail

- Independent news, sports, weddings, corporate events

- TV+film, advertising, corporate training

What we found from our qualitative research work was that irrespective of what genre they specialized in for traditional content creation, they were motivated to dabble in all three when it came to VR. Hence the sort of device they needed was a multipurpose camera. The only way there was to shoot VR content at that time and in the price bracket of the indie professional was to use a 6 (action) camera rig. The workflow was dire in that it required a significant amount of time to set up and was totally unreliable. There was no way to preview the footage (Live View) and gauge where the stitch lines were. Post processing was nightmare with 6 different files. See the details captured in the Customer Journey map, a useful tool from the Design Thinking process, below.

At the end of our qualitative sessions we knew what to ideate on. See attached a mind map, another design thinking tool, which captured the key opportunities for the brainstorming process.

At the end of the brainstorming process, the product hypothesis that takes shape is a camera that is single bodied with 6 lenses delivering benefits of Live Preview and single file output. The camera wouldn’t have an internal battery or memory. While this sounds counter-intuitive, having these two pieces external to the product would deliver the following benefits a) longer duration of shoots possible as external recorders and battery packs are significantly larger in size b) The cost of the camera itself could thus be reduced and that of the entire bundle as well, as most professionals already owned battery packs and external recorders. Mobility was something the participants were willing to tradeoff on.

Follow up with Quantitative research to validate the hypothesis that was generated at the end of the Qualitative research phase. The focus here should really be to hone in on the feature set of the product/product portfolio and the price points. I have covered this topic in quite some detail in a separate write up (here). Going back to my example, understanding what features to keep and what to take away to hit a specific price point is a standard DCM (choice based conjoint) analysis. Back to my example, the Quantitative research confirmed the approach i.e. mobility was something the participants were willing to sacrifice for the right price. The analysis also confirmed that the flagship product and this budget product could co-exist (increased preference share with two products over a single product on running a turf simulation).

Development Phase

The development phase is where all the engineering is done. Towards the initial part of the phase, the ID (Industrial Design) concepts will take shape. You’ll want to get feedback on what customers think of the ID options. Also, you’ll need to figure out how many different colors and what material finishes to carry. All these are perfect questions to put to a Focus Group.

The material for these focus groups should be the physical prototypes (they needn’t be working), failing which at least high resolution images that are printed to size. Make sure you pick the audience for your groups well. It makes sense to have a group session with target customers who are not existing customers, and another with existing/loyal customers. Having a session with loyal customers will give you a good sense of what it is that you do well, and if that’s a unique design language, then you want to make sure that if its working for you, you don’t stray from it. And also a good split of women and men, unless you’re making something very gender specific like a beard trimmer. Last but not the least, another invaluable benefit of these focus group discussions is that it will give you plenty of insights to position your products. You could even go into these sessions prepared with taglines and see which ones resonate in general.

Follow this up with some quantitative work. ID preference test could be a simple multiple choice question where participants are asked to pick their preferred option or none at all. Color and Materials quality (e.g. Leather, Fabric, Carbon fiber, Steel etc.) can be run as a conjoint analysis (see Fig 1). The benefit of the conjoint method is that you can also introduce price as an attribute which means you can explore if there is a possibility to charge a premium for a color and or finish material. Additionally, Conjointly offers a module called the Product Variant test that is a choice based test similar to the conjoint but without price considerations. Here is an example of how that would look to the test taker.

If it is just color or flavors that you want to test out, this is a viable option. Given that both the Conjoint analysis and the Product Variant test are choice based analyses, you will be able to use the data to run a Turf analysis which will help you finalize the SKUs (variants) for that product.

Last but not the least, the Packaging concepts should also be tested to make sure that they align with the Brand identity.

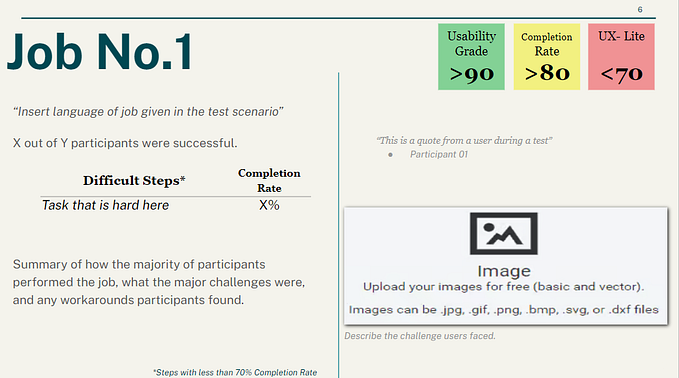

As we progress in the product development stage to when the working prototypes are ready, it is time to run a Usability test. The Usability test not only allows you to identify any issues with the user experience, but also allows you to get early feedback on the functioning product. Usability tests are conducted on a one on one basis.

Manufacturing & Launch

You’ve tested the daylight out of your product ideas (paper and prototype) but now you need to commit to a quantity to manufacture. All your research has proven that your target segment will pay $X for your product, and you’ve come up with a neat forecast. But its still gives you the shivers. One way to continue in the testing vein is to put the product up for pre-orders. Kickstarter or Indigogo will allow you to test the potential of a concept with the tech enthusiastic millennial cohort. If you’re a popular brand like Tesla, then all you need to do is put the product up for preorders on your own website (Well if you’re Tesla, you may even be able to get away by testing concepts via pre-orders prior to development commencing). By making people put their money where their mouth is, you will know soon enough if the idea is worth backing prior to getting into the most expensive phase i.e. manufacturing.

Where does Design Thinking fit into this framework

Design thinking, as I see it, has two core tenants

(i) Qualitative research to inform us of unarticulated needs

(ii) A product development process that is iterative in nature such that failures can be identified quickly so that its impact is cheap

The NPD process that I’ve described here contains all the elements (activities) of design thinking. All the qualitative research work within the Strategy Phase informs the “What is” and “What if” phases. I’d argue that all the Quantitative work that’s done really informs both the “what wows” and the “what works” phase. The DCM analysis described is here akin to a real world buying experiment with multiple concepts tested at various price points, and thereby fulfills to a limited extent the role of the Learning Launch in the design thinking process. I would also argue that all the work that is done in what I describe as the development phase involving real working prototypes is the continuation of that Learning Launch activity which culminates at the pre-order stage, the real Learning Launch test.

Where the presented framework diverges from the standard Design Thinking Process is the reliance on business case to make the decision to move the project to the development phase. While one of the key tenants of design thinking is the importance of testing an MVP each of all the ideas using learning launches to gauge which ones works, this is hard to do in a hardware world where development to prototype is much longer and therefore the resources required to support all the ideas significantly more. Therefore there is a need to have a filter of ideas prior to the development stage as seen in the traditional product development process. The Business case is used as the tool to filter ideas. To assuage the sentiments of the pious adherents of design thinking, the business case could do away with any sort of forecasts, specifically when the idea is a foray into a new category. Instead it should focus on the total addressable market (TAM), the beachhead and the level of interest within it as proved from the research findings.

Conclusion

While the design thinking method fits easily into the agile software development process, I’m certain a lot of product managers in traditional hardware organizations will squint at it. By incorporating testing through research at every stage of the traditional method, I have shown how this aligns with the design thinking method. Also, with the plethora of tools to run cheap research, some of which I’ve specified here, this is an approach every organization, big or small, can use.

Useful Resources

- How to conduct interviews https://learn.marsdd.com/article/interviewing-potential-users/

- How to conduct focus groups https://learn.marsdd.com/article/focus-groups/

- Usability testing https://medium.com/usabilitygeek/usability-testing-with-prototypes-34b0d145c97

- Mind maps https://uxdesign.cc/mind-maps-how-i-boosted-productivity-and-took-learning-quality-to-new-a-level-a586ade9a439

- Customer journey mapping https://medium.com/choice-hacking/how-to-create-a-customer-journey-map-ffbd580284d7

- Business model Canvas https://medium.com/world-of-iot/why-platform-businesses-need-a-new-business-canvas-7b6f9fe4308b

- Tools for Customer journey mapping and mind (opportunity) mapping https://miro.com/app/dashboard/